Cryptocurrency mining websites offer dual entry paths for aspiring digital prospectors: software solutions leveraging existing hardware or cloud platforms requiring only capital investment. The former demands technical acumen but minimizes costs, while the latter trades simplicity for upfront fees. Notable platforms like ECOS (government-backed) and green energy operations reflect the sector’s evolution beyond mere profitability. Security credentials, realistic earnings projections, and user experience remain critical evaluation metrics for this peculiar digital gold rush.

How exactly does one participate in the digital gold rush of cryptocurrency mining without investing in a warehouse of hardware?

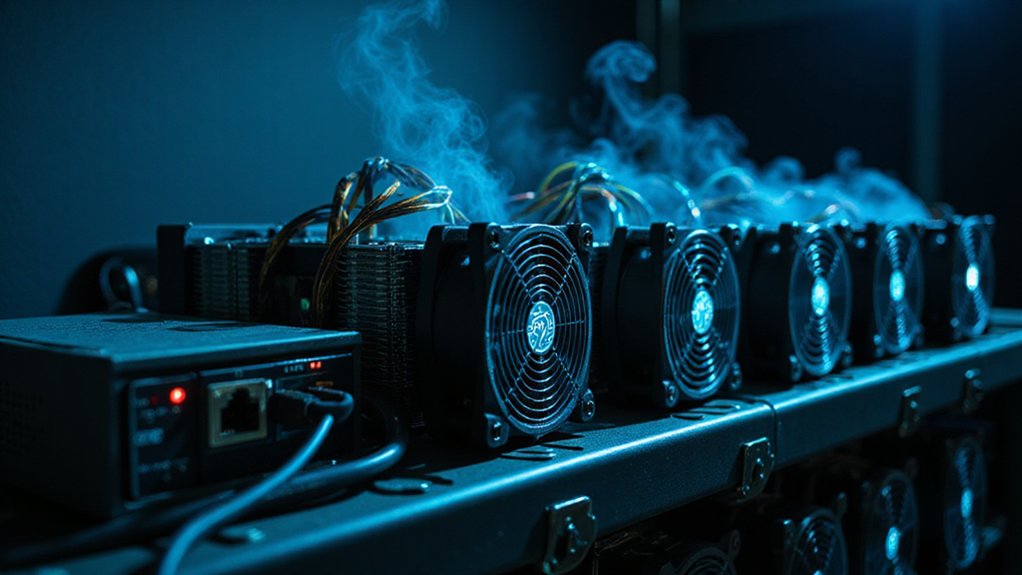

The answer lies in the expanding ecosystem of mining websites that have proliferated across the internet—platforms designed to facilitate entry into what was once an impenetrable technological fortress.

These services bifurcate into two principal categories: software-based solutions for those with existing hardware and cloud mining platforms for the equipment-averse.

Cryptocurrency mining’s digital gateway presents a dichotomy: software for hardware owners and cloud platforms for technical minimalists.

The software approach appeals to users who possess the requisite hardware but lack the technical acumen to orchestrate the mining process independently.

Leading programs in 2025 offer varying degrees of GPU and ASIC compatibility, integration with established mining pools, and real-time monitoring capabilities—often without monetary cost, though the technical learning curve constitutes its own form of payment.

For those disinclined to navigate hardware complexities (or who balk at the notion of their electricity bill funding what amounts to sophisticated mathematical guesswork), cloud mining platforms present an attractive alternative.

These services basically rent hash power to users through contracts of varying durations and financial commitments.

The proposition is elegantly simple: financial investment in lieu of technical knowledge and hardware management.

Through cloud mining, participants receive proportional mining rewards based on the amount of computing power they’ve purchased, eliminating the need for technical expertise or physical equipment maintenance.

Particularly notable are government-backed operations such as ECOS, functioning within Armenia’s Free Economic Zone.

Such platforms offer enhanced legitimacy—a valuable commodity in a sector plagued by ephemeral operations and outright fraudulence—though often with limitations on cryptocurrency diversity and occasional withdrawal friction during market upswings.

Newer entrants like SpeedHash have introduced incentive-based models, offering trial mining bonuses that permit experimentation without initial capital outlay.

Their emphasis on green energy utilization reflects evolving priorities beyond mere profitability.

Some providers like the UK-based operation founded in 2019 employ 100% green energy from hydro, wind, and solar sources for their mining operations, addressing environmental concerns associated with cryptocurrency mining.

When evaluating potential platforms, astute investors consider three critical factors: security credentials (including regulatory compliance), realistic profitability projections amid market volatility, and user experience metrics such as interface intuitiveness and support responsiveness.

The ideal mining website transforms a byzantine process into a navigable journey through cryptocurrency’s potential rewards—without requiring users to distinguish a hash from a hedgehog.

Frequently Asked Questions

How Much Electricity Does Mining Cryptocurrency Consume?

Cryptocurrency mining consumes substantial electricity—Bitcoin alone uses between 155-172 TWh annually, comparable to Poland’s entire national consumption.

Mining operations collectively represent 0.6-2.3% of U.S. electricity usage, with domestic facilities reaching a maximum capacity of approximately 10,275 MW.

Operating typically at 80% capacity, these operations consume roughly 70 TWh yearly.

This energy-intensive process (unsurprisingly drawing regulatory scrutiny) contributes greatly to environmental concerns, particularly when powered by fossil fuels rather than renewable alternatives.

Can I Mine With My Regular Laptop or PC?

¹The economics become particularly grim when factoring in reduced hardware lifespan against negligible earnings.

Are Mining Pools Better Than Solo Mining?

Whether mining pools trump solo mining depends entirely on one’s circumstances.

For the average miner with modest computing resources (read: not operating a warehouse of ASICs), pools offer steadier, albeit smaller, payouts—effectively transforming mining from a lottery into a predictable income stream.

Solo mining, while potentially more lucrative when lightning strikes, subjects participants to extended dry spells that can test even the most patient investor’s resolve.

Risk tolerance and available hash power should dictate your choice.

What Happens to Mining After All Coins Are Mined?

After all 21 million bitcoins are mined (projected around 2140), the mining landscape undergoes a fundamental transformation.

Miners must pivot from block rewards to transaction fees as their sole revenue stream—a seismic shift in incentive structures.

Network security will hinge entirely on whether these fees provide sufficient economic motivation to maintain mining operations.

Layer 2 solutions like Lightning Network may become increasingly essential, while the economics of mining will likely reach a new equilibrium based on transaction volume and fee markets.

How Do I Calculate Mining Profitability Before Starting?

To calculate mining profitability, one must employ a formula that balances potential revenue against operational costs.

Miners should utilize specialized calculators (NiceHash, WhatToMine, CryptoCompare) that account for hash rate, mining difficulty, block rewards, electricity costs, and hardware depreciation.

The prudent miner conducts break-even analysis before committing capital—a step surprisingly overlooked by enthusiastic newcomers.

Market volatility remains the wild card; today’s profitable coin might become tomorrow’s digital paperweight.

Pool selection with minimal fees further optimizes returns.