Bitcoin mining requires substantial investment in specialized ASIC hardware, reliable power supply, and cooling systems—a far cry from the CPU mining of bygone days. Beginners should calculate profitability considering electricity costs, join established mining pools like F2Pool or Antpool to stabilize returns, and configure mining software such as CGMiner with their wallet address. The economic viability hinges on regional electricity rates and evolving network difficulty, making relocation to areas with cheaper power practically mandatory. The following sections illuminate whether this digital gold rush remains worth your kilowatt-hours.

Why, in an era of convenient digital investments, would anyone venture into the complex and energy-intensive world of Bitcoin mining?

The allure persists: direct participation in blockchain validation while potentially accruing newly minted Bitcoin—cryptocurrency’s equivalent of striking gold in one’s digital backyard.

Bitcoin mining fundamentally involves verification of transactions and their addition to the blockchain ledger.

Miners deploy computational resources to solve mathematical puzzles, with successful solutions rewarded in Bitcoin.

This process simultaneously maintains network integrity and distributes new currency—an elegant symbiosis of security and monetary policy.

The contemporary mining landscape bears little resemblance to its CPU-based origins.

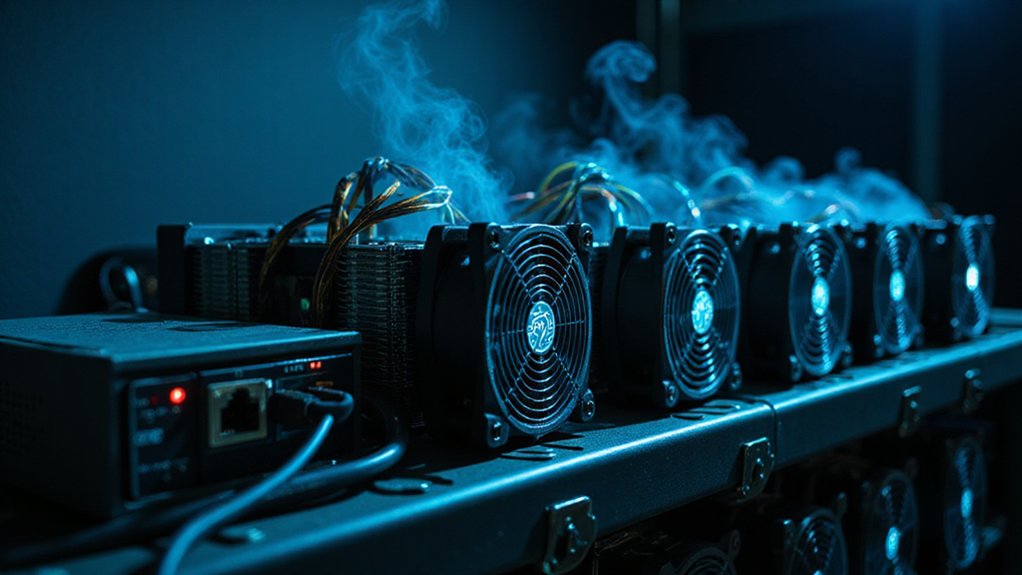

Today’s serious miners deploy Application-Specific Integrated Circuits (ASICs), devices engineered exclusively for mining efficiency.

A proper setup necessitates substantial power supply units (typically 1000W+), robust cooling systems (miners generate prodigious heat), and stable Ethernet connectivity (Wi-Fi introduces unacceptable latency).

Environmental considerations cannot be overlooked; many operations relocate to regions with inexpensive electricity—a telling economic imperative¹.

The industry has seen equipment costs decrease to approximately 16 dollars per terahash, making advanced ASIC miners more accessible to newcomers.

To achieve operational viability, miners typically join mining pools, collaborative arrangements whereby participants combine computational resources and share rewards proportionally to contributed hash power.

Popular collectives include F2Pool, Antpool, and Slush Pool, each offering subtly different reward structures and fee arrangements.

This approach provides steadier, albeit smaller, returns than the feast-or-famine proposition of solo mining.

The network’s difficulty level adjusts regularly to maintain a consistent block discovery rate, making pool participation increasingly essential for individual miners.

Software configuration presents another critical consideration.

Programs like CGMiner require specification of pool URLs, worker identifications, and wallet addresses for reward collection.

Regular firmware updates optimize performance and address security vulnerabilities—a maintenance necessity often underappreciated by neophytes.

Beginners might consider user-friendly alternatives such as EasyMiner or MultiMiner, which offer intuitive graphical interfaces while still providing access to advanced features.

For beginners contemplating entry into this computational contest, a realistic assessment of financial viability proves essential.

The substantial initial investment—equipment acquisition, environmental modifications, and electricity costs—must be weighed against decreasing block rewards and increasing network difficulty.

Mining represents not merely an investment strategy but a technological commitment requiring ongoing adaptation to evolving network dynamics.

¹The carbon footprint implications merit their own separate ethical consideration.

Frequently Asked Questions

What Are the Tax Implications of Bitcoin Mining Profits?

Bitcoin mining profits face a dual tax burden: they’re classified as ordinary income at fair market value upon receipt (yes, even before selling), and later subject to capital gains when liquidated.

Miners operating as businesses can deduct equipment and electricity expenses—a small mercy—but must maintain meticulous records of mining dates, quantities, and values.

The IRS, increasingly vigilant about digital assets, expects full compliance despite the computational gymnastics required to track one’s tax liability.

Can I Mine Bitcoin on My Laptop or Smartphone?

While technically possible, mining Bitcoin on consumer devices represents a quixotic endeavor at best.

Laptops and smartphones lack the computational muscle to compete with purpose-built ASICs, rendering the practice economically irrational—the electricity costs would exceed any potential rewards.

The hardware strain would be considerable as well; one might as well use one’s device as an inefficient space heater.

Alternative cryptocurrencies with less demanding algorithms might offer marginally better prospects, but expectations should remain firmly earthbound.

How Much Electricity Does Bitcoin Mining Actually Consume?

Bitcoin’s electricity consumption is staggeringly high—estimates range from 80 to 390 TWh annually, roughly equivalent to entire nations like Finland.

This remarkable energy appetite stems from the network’s design, which deliberately increases computational difficulty as more coins are mined.

One transaction consumes energy equivalent to hundreds of thousands of VISA transactions, a fact that has prompted sustainability debates within the cryptocurrency community.

Are There Mining Pools Specifically for Beginners?

Yes, several mining pools cater specifically to beginners.

F2Pool, ViaBTC, Antpool, and Luxor Pool offer user-friendly interfaces, detailed guides, and lower minimum payout thresholds—critical for those with modest hash rates.

These beginner-oriented pools typically feature transparent payout structures (PPS or FPPS), simplified setup processes, and robust support forums.

When selecting a pool, neophyte miners should consider fee structures, payout frequency, pool size (larger pools provide more consistent, albeit smaller, rewards), and geographic server proximity to minimize latency.

What Happens to Bitcoin Mining After All Coins Are Mined?

After Bitcoin’s 21 million supply cap is reached (circa 2140), mining undergoes a fundamental shift—block rewards evaporate, leaving transaction fees as miners’ sole revenue stream.

This shift transforms the economic incentive structure without disrupting the network’s security model.

Miners will continue validating transactions, but profitability will hinge entirely on fee volumes.

Layer 2 solutions may proliferate as on-chain transactions potentially become prohibitively expensive for everyday use, creating a two-tiered ecosystem where Bitcoin primarily functions as digital gold rather than quotidian currency.