The crypto ecosystem is rapidly evolving beyond its speculative origins into a sophisticated financial landscape projected to reach $5 billion by 2030. Regulatory frameworks—though still developing amid spectacular implosions like FTX—are gradually providing stability to the market. Technological innovations, including AI integration and multichain capabilities, continue transforming investor engagement while DeFi applications bridge traditional finance gaps. Fractional ownership models democratize access to previously exclusive asset classes, suggesting blockchain’s potential for financial democratization extends far beyond its current implementation.

The cryptocurrency ecosystem stands at an inflection point, poised between explosive potential and regulatory reckoning.

With projections indicating a market value surge from $2.1 billion to $5 billion by 2030, the emerging bull market—fueled by ETF approvals and burgeoning investor confidence—signals a maturation phase that even traditional finance cannot ignore.

The explosive growth trajectory of crypto markets reveals an unmistakable truth—digital assets have transcended novelty to become an economic force traditional finance must reckon with.

The remarkable 92% of U.S. crypto holders expressing optimism about blockchain’s economic modernization potential underscores a shift from speculative fascination to practical implementation.

Regulatory clarity, once an afterthought in crypto’s Wild West era, has become the lynchpin of sustainable growth.

Nearly half of American crypto investors prioritize enhanced security and anti-fraud standards—a rather sensible position given the sector’s occasionally spectacular implosions.¹

The global regulatory patchwork, while challenging for businesses managing cross-jurisdictional compliance, ultimately strengthens the ecosystem’s foundation (though one might question whether regulators fully comprehend the technology they’re attempting to govern).

DeFi’s integration with traditional finance and stablecoins’ expansion into cross-border transactions represent crypto’s evolution from novelty to utility.

These developments offer practical financial solutions while maintaining blockchain’s innovative essence—a rare feat in technological evolution.

PancakeSwap exemplifies this evolution with its multichain DeFi capabilities that have helped it achieve nearly $2 billion in total value locked by 2025.

The Cryptocurrency Software segment is set to experience remarkable growth with a 17.3% CAGR through the analysis period, highlighting the industry’s shift toward software solutions and services.

Meanwhile, AI’s infiltration into crypto trading and market analysis introduces efficiencies that would have seemed fantastical just years ago, transforming how investors interact with digital assets.

The convergence of AI and cryptocurrency has been particularly evident in the market, with AI-related tokens growing from a modest $2.7 billion to an impressive over $39 billion in just one year.

Tokenization continues reshaping traditionally illiquid markets like real estate, while NFTs—despite occasional eye-rolling valuation excesses—demonstrate blockchain’s capacity for authenticating digital uniqueness.

This fractional ownership model democratizes access to previously exclusive asset classes, though whether this democratization ultimately benefits average investors remains an open question.

As this ecosystem evolves, the symbiotic relationship between innovation and regulation will determine whether crypto fulfills its transformative promise or devolves into a historical footnote.

The coming years will reveal if blockchain technology can transcend its speculative origins to deliver the financial paradigm shift its proponents have long prophesied.

¹ One need only recall the Terra Luna collapse or FTX’s spectacular implosion.

Frequently Asked Questions

How Do Crypto Regulations Differ Across Major Global Markets?

Crypto regulations across major markets present a fascinating patchwork of approaches.

The EU’s MiCA aims for standardization, while the U.S. relies on fractured oversight between SEC and CFTC—a recipe for regulatory uncertainty if ever there was one.

China maintains its hardline stance, Singapore balances innovation with compliance through regulatory sandboxes, and Switzerland offers crypto-friendly clarity.

Meanwhile, El Salvador and the Central African Republic have gone all-in on Bitcoin, seemingly unbothered by the regulatory hand-wringing elsewhere.

What Environmental Impact Do Different Consensus Mechanisms Have?

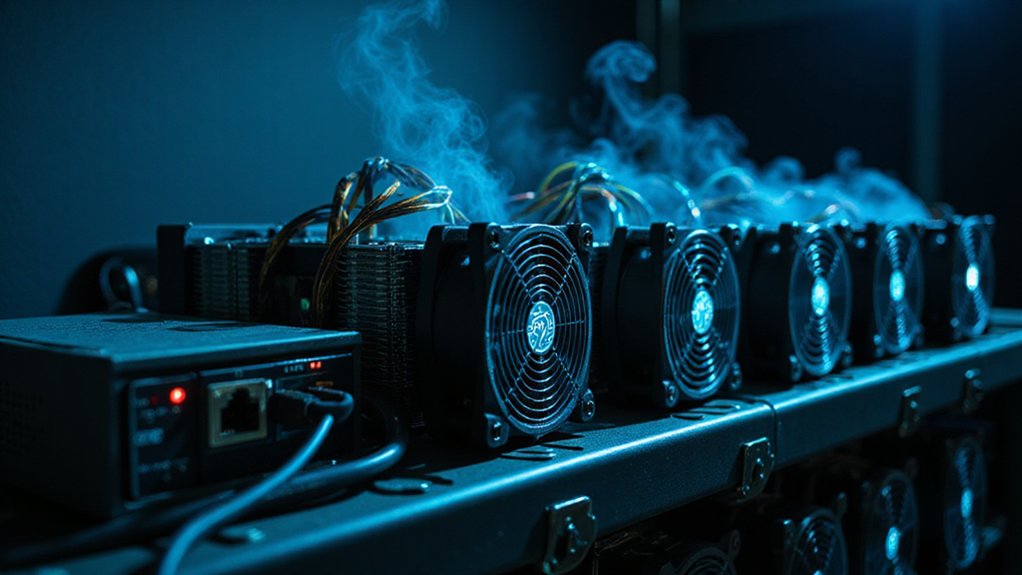

Consensus mechanisms exhibit starkly different environmental profiles across the crypto landscape.

Proof-of-Work demands electricity consumption rivaling small nations, with Bitcoin’s carbon footprint becoming increasingly indefensible in climate-conscious markets.

Proof-of-Stake offers a 99% reduction in energy usage—rather a significant improvement, one might say.

Alternative mechanisms like DPoS and PBFT further minimize ecological damage.

Regulators worldwide have noticed this discrepancy, with greener consensus mechanisms increasingly becoming mandatory rather than optional for blockchain adoption.

How Can Beginners Safely Start Investing in Cryptocurrencies?

Beginners can safely venture into cryptocurrency by starting on reputable exchanges (Coinbase, Binance) while implementing robust security measures—two-factor authentication is non-negotiable in this wild financial frontier.

After establishing secure wallets—preferably cold storage for significant holdings—neophytes should diversify modestly across established assets rather than chasing obscure altcoins.

The prudent investor commits only expendable capital, recognizing that crypto remains an asset class where spectacular gains and stomach-churning losses coexist with remarkable frequency.

What Cybersecurity Measures Protect Crypto Exchanges From Hackers?

Crypto exchanges deploy multi-layered security protocols to fend off increasingly sophisticated threat actors.

Cold storage keeps the majority of assets offline (where hackers can’t reach them), while robust authentication systems and real-time monitoring create defensive perimeters.

Regular smart contract audits, whitehat hacker bounty programs, and blockchain intelligence tools further fortify operations.

Ironically, the decentralized ethos of crypto relies heavily on centralized guardianship—exchanges that must maintain regulatory compliance while simultaneously defending against relentless attack vectors.

How Will Quantum Computing Affect Blockchain Security?

Quantum computing poses an existential threat to blockchain security by potentially breaking cryptographic algorithms that underpin the entire system.

Shor’s algorithm could render elliptic curve cryptography obsolete, while Grover’s algorithm might compromise hash functions.

The industry’s response includes implementing quantum-resistant cryptography like lattice-based systems and hash-based signatures.

While functional quantum computers remain years away, the blockchain community faces a peculiar race—implement solutions before quantum capabilities mature enough to exploit vulnerabilities.

Some developers, remarkably, seem unfazed by this looming cryptographic apocalypse.