Memecoins have exploded from $68.5 billion to a projected $925.2 billion by 2035, transcending their joke origins to become legitimate financial instruments. Despite lacking practical utility, tokens like DOGE, SHIB, and the recently surging TRUMP command billion-dollar valuations through community dynamics and social virality. The sector’s 26.7% CAGR outpaces traditional investments, attracting everyone from retail enthusiasts to institutional players. North America leads this peculiar financial revolution, while Asia Pacific regions present the frontier for tomorrow’s digital wealth creation.

Where exactly does one draw the line between legitimate financial innovation and digital-age tulip mania?

The meteoric rise of memecoins—valued at $68.5 billion in 2024 and projected to reach a staggering $925.2 billion by 2035—suggests this question warrants serious consideration.

With expected CAGR of 26.7% over the next decade and market capitalization poised to septuple from $20 billion to $140 billion in just one year, memecoins are transcending their comedic origins to become financial phenomena of considerable magnitude.

The current landscape features established players like DOGE, SHIB, and PEPE capturing significant portions of the 2.5% share memecoins hold in the broader cryptocurrency market.

Veterans DOGE, SHIB, and PEPE dominate the memecoin sector, carving out notable territory within crypto’s rapidly evolving frontier.

Meanwhile, newcomers emerge at breakneck pace—Solana alone saw over 5 million tokens minted in 2024, with nearly 70,000 projects entering an increasingly crowded marketplace.

Particularly within the Solana ecosystem, unique tokens like Sealana and BONK have gained traction for their community-driven approaches and distinctive characters that resonate with investors.

Cat-themed tokens, once an afterthought, have seen their collective value surge from $50 million to $1.8 billion, while TRUMP reached a market capitalization of $8.3 billion in early 2025.

These assets exhibit peculiar characteristics that challenge conventional investment wisdom: they typically lack practical utility yet demonstrate remarkable price appreciation driven primarily by social media virality and community dynamics.

This speculative nature attracts a diverse array of market participants—from retail investors to sophisticated traders and institutional “whales”—all maneuvering an environment characterized by extreme volatility and regulatory ambiguity.

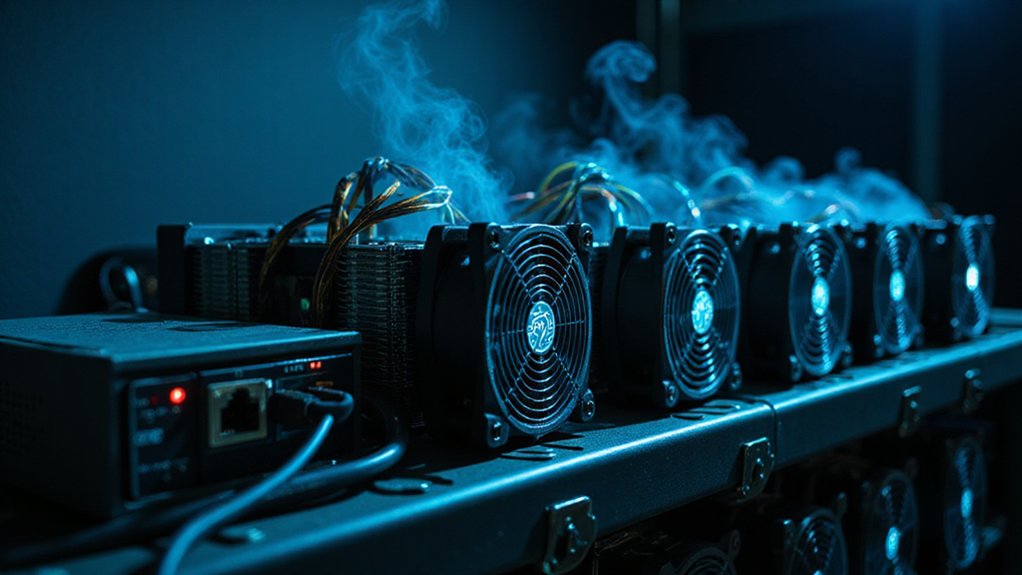

The technological infrastructure continues to evolve, with platforms like Solana, Base, Injective, and TON competing to provide ideal environments for memetic assets.

Their emphasis on throughput, cost-efficiency, and user experience facilitates the explosive growth of these ecosystems.

North America currently dominates as the largest memecoin market, with Asia Pacific regions showing the most rapid growth potential for these digital assets.

The President-elect’s launch of Official Trump coin represents a permanent shift validating meme coins as legitimate financial instruments rather than mere jokes or scams.

The central question remains: Do memecoins represent the democratization of finance—allowing ordinary individuals to participate in potentially lucrative speculation previously reserved for accredited investors—or are they simply the latest manifestation of irrational exuberance?

The answer likely lies somewhere between these extremes, though one might reasonably observe that when cat pictures command billion-dollar valuations, traditional financial wisdom deserves reconsideration.

Frequently Asked Questions

How Do Meme Coins Impact Traditional Cryptocurrency Market Stability?

Meme coins inject unprecedented volatility into cryptocurrency markets, functioning as destabilizing agents that can trigger market-wide ripple effects.

Their price movements—dictated by social media fervor rather than fundamentals—create speculative frenzies that divert attention from substantive projects.

This volatility (50 times that of Bitcoin) compounds regulatory concerns, as these digital curiosities operate largely outside established frameworks.

Consequently, meme coins‘ explosive popularity can undermine broader market credibility, eroding institutional confidence while simultaneously overshadowing legitimate technological innovation in the blockchain space.

What Regulations Specifically Target Meme Coin Trading?

Currently, no federal regulations specifically target meme coin trading.

The SEC has explicitly excluded meme coins from securities regulations, creating a regulatory vacuum that state authorities are scrambling to fill.

New York’s NYDFS has stepped into the breach with state-level monitoring, while the FTC may intervene in cases of deceptive marketing practices.

This patchwork approach creates a regulatory arbitrage opportunity that savvy (or perhaps reckless) traders are quick to exploit.

Can Meme Coins Survive Market Corrections Better Than Utility Tokens?

Contrary to intuition, established meme coins may actually demonstrate remarkable resilience during market corrections.

Their community-driven nature creates a loyalty buffer that transcends rational valuation metrics—when your investment thesis is primarily emotional rather than utilitarian, fundamental deterioration matters less.

Utility tokens, despite their practical applications, can suffer more dramatically when their technological promises face market skepticism.

The paradox remains that meme coins’ very lack of utility sometimes insulates them from utility-based criticisms during bearish cycles.

How Do Institutional Investors View Meme Coin Investments?

Institutional investors generally regard meme coins with wary skepticism, viewing them as speculative vehicles rather than legitimate investment assets.

While some forward-thinking funds have cautiously allocated small portions of their portfolios to capture potential upside, the absence of fundamentals, regulatory uncertainty, and extreme volatility keep most institutions at arm’s length.

The projected meme coin ETF in 2025 might bridge this gap, offering a structured entry point that could potentially legitimize these assets within traditional financial frameworks.

What Blockchain Technologies Best Support Meme Coin Development?

Ethereum remains the dominant blockchain for meme coin development, offering robust ERC-20 standards and widespread exchange acceptance—despite its notorious gas fees that can make creators question their life choices.

Binance Smart Chain provides a cost-effective alternative with BEP-20 tokens, while Polygon offers scalability advantages.

For projects prioritizing transaction speed, Solana presents compelling benefits, though with less established infrastructure.

The ideal platform ultimately depends on the developer’s priorities: accessibility, cost-efficiency, or transaction velocity.