The Markets in Crypto-Assets (MiCA) regulation represents the EU’s first thorough crypto framework, entering force June 2023 with full implementation by December 2024. This landmark legislation establishes uniform standards across member states—eliminating regulatory arbitrage while imposing disclosure requirements on issuers, exchanges, and even influencers. With its tiered approach to asset-referenced tokens, e-money tokens, and utility tokens, MiCA attempts the regulatory high-wire act of protecting consumers without stifling innovation. The framework’s two-year implementation period offers a fleeting window for adaptation.

The European Union’s Markets in Crypto-Assets Regulation (MiCA) represents perhaps the most ambitious regulatory framework to date for bringing order to the proverbial Wild West of digital assets.

MiCA stands as Europe’s bold declaration that the crypto frontier will no longer operate beyond regulatory reach.

Entering into force on June 29, 2023, with full application commencing December 30, 2024, this extensive legislation addresses a broad spectrum of crypto offerings—from stablecoins to utility tokens—that previously existed in regulatory limbo.

MiCA emerges as the culmination of years of EU deliberation on how to balance innovation with consumer protection.

Its architects have crafted a regime that imposes uniform standards across all member states, thereby eliminating the regulatory arbitrage that has long been the bane of coherent financial governance.

The framework’s ambitions are nothing if not sweeping: transparency requirements, authorization protocols, and supervisory mechanisms that apply to issuers and service providers alike.

What distinguishes MiCA from its regulatory predecessors is its meticulously calibrated approach to market integrity.

Rather than stifling innovation through blunt-force restrictions, it establishes parameters within which crypto entrepreneurs can operate with a degree of certainty previously unavailable.

Exchanges, trading platforms, and—perhaps most particularly—influencers hawking digital assets will find themselves subject to unprecedented scrutiny.

For consumers, MiCA promises protections that have been conspicuously absent in the crypto sphere.

The days of caveat emptor as the sole guiding principle for digital asset investments appear numbered, with explicit disclosure requirements forcing issuers to articulate risks that might otherwise remain conveniently obscured.

The European Securities and Markets Authority (ESMA) will issue supervisory guidelines by mid-2025, while national competent authorities shoulder enforcement responsibilities.

This two-tier approach—centralized standards with localized enforcement—reflects the EU’s characteristic regulatory philosophy.

Member States implementing transitional measures will allow existing crypto service providers to continue operations until July 2026, creating a grandfathering period for businesses to adapt to the new regulatory landscape.

Unlike the United States where mining regulations vary by state while remaining legal at the federal level, MiCA provides a consistent approach across all EU member states.

Whether MiCA will achieve its lofty ambitions remains to be seen.

The regulation specifically targets three categories of crypto assets including asset-referenced tokens, e-money tokens, and other crypto-assets like utility tokens.

What is certain, however, is that it has established a regulatory benchmark against which all future crypto governance frameworks will inevitably be measured—a telling indication of Europe’s determination to shape the future of finance rather than merely respond to it.

Frequently Asked Questions

How Does MICA Impact NFTS and Defi Platforms?

MiCA impacts NFTs and DeFi platforms through a regulatory framework that—depending on token characteristics—may subject them to stringent operational requirements.

While promising market transparency and consumer protection, MiCA potentially compromises the decentralized ethos of these innovations.

DeFi platforms face licensing hurdles that could fundamentally alter their autonomous nature, while certain NFTs may escape regulation entirely.

The legislation’s cross-border standardization offers clarity but simultaneously threatens the libertarian underpinnings that initially propelled these digital assets to prominence.

What Penalties Exist for Non-Compliance With MICA Regulations?

Non-compliance with MiCA triggers a veritable arsenal of punitive measures.

Entities face potential fines of €5,000,000 or 3-12.5% of annual turnover (whichever induces more financial pain), while individuals may confront penalties up to €5 million.

Beyond mere monetary extraction, authorities wield the power to revoke licenses, permanently ban operations, and restrict market access—effectively commercial death sentences.

The cumulative effect: a regulatory framework with teeth sharp enough to sever non-compliant business models at the root.

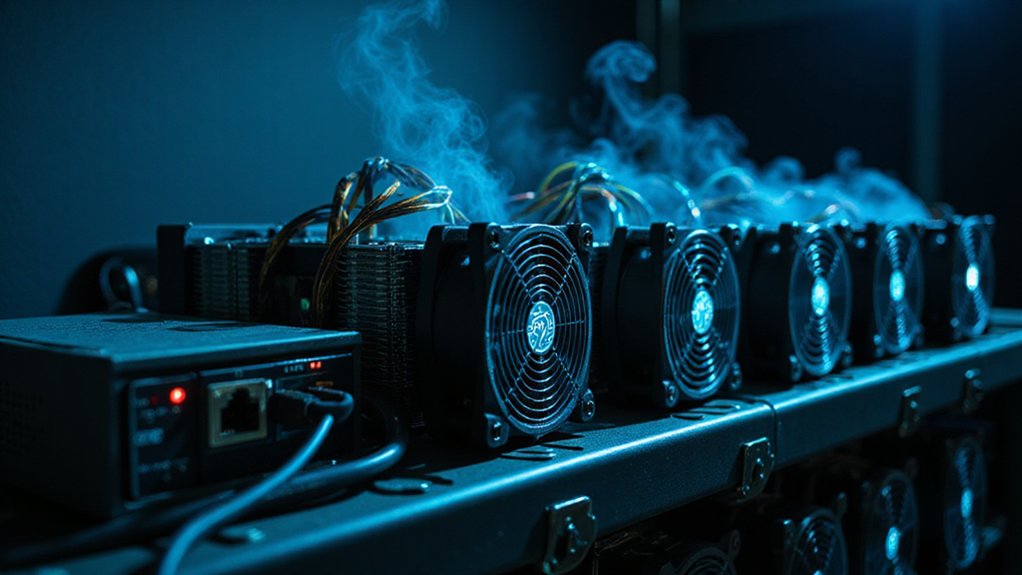

How Will MICA Affect Crypto Mining Operations?

MiCA’s impact on crypto mining operations is significantly minimized, as ESMA has explicitly exempted miners from classification as PPAETs, sparing them from onerous market abuse reporting obligations.

While proof-of-work mining faced potential prohibition due to environmental concerns, MiCA ultimately sidestepped an outright ban.

Nevertheless, miners should remain vigilant—the regulatory framework’s environmental focus suggests future iterations might target mining’s energy consumption patterns, potentially necessitating adaptations toward more sustainable operational models.

Can Existing Cryptocurrencies Be Grandfathered in Under MICA?

MiCA doesn’t “grandfather” existing cryptocurrencies per se, but rather the service providers that handle them.

Entities operating legally before December 30, 2024 may continue under national laws until July 2026, depending on their member state’s discretion.

This interim period—which varies dramatically across jurisdictions—offers breathing room without the coveted EU passporting privileges.

Eventually, all providers must align with MiCA‘s framework, rendering this regulatory respite merely temporary rather than a permanent exemption.

Will MICA Regulations Slow Crypto Innovation Within the EU?

MICA regulations will likely create a dual effect on EU crypto innovation.

While establishing regulatory clarity that benefits larger players with compliance resources, the framework simultaneously imposes burdens disproportionately affecting smaller firms—traditionally innovation’s lifeblood.

This regulatory asymmetry may inadvertently foster market consolidation, with established entities thriving while nimble startups struggle under compliance costs.

The question isn’t whether innovation continues, but rather who remains positioned to innovate within this reconfigured competitive landscape.